2025 Recommendations for Securing Tax Credits for Your Solar Projects

Recently, the political landscape in the US has felt increasingly uncertain. Between ping-ponging tariffs and potential changes to the 2026 tax code, large construction projects like solar PV might feel like a more risky investment than it did a year or two ago. While we do not have any way of predicting exactly how all of these policies will shake out, we have reason to believe that many of the policies that make solar a worthwhile investment will remain in place. Beyond federal tax credits, the rapidly increasing cost of electricity and the soon-to-be finalized SMART 3 program continue to make solar a great solution for Massachusetts organizations looking to decrease their operating costs and build resiliency.

According to a Financial Times analysis, in its first year, the Inflation Reduction Act (IRA) spurred $180 billion of investment in districts represented by Republicans in Congress, compared to approximately $10 billion in districts represented by Democrats. The solar investment tax credit (ITC) represents billions of dollars in investments across projects ranging from small residential (IRC Section 25D) systems to commercial and utility-scale projects (IRC Section 48) costing hundreds of millions of dollars. The country’s largest financial institutions are highly involved in this investment pipeline and have been actively lobbying congress to maintain the IRC Section 48 30% business investment tax credit that is critical for solar projects large and small. Solar has widespread, bipartisan support and most industry experts believe it is unlikely that congress will eliminate the provision entirely.

That being said, there still is some concern that other parts of the solar tax credit landscape included in the Inflation Reduction Act, like the Low-Income Bonus Tax Credit Adders and Elective Pay provisions, could be on the chopping block for FY 2026 and beyond. We expect more information about any changes to the tax code will be available in the summer and fall – sign up for our newsletter to stay on top of all of the newest solar policy updates.

In the meantime, here are Resonant’s suggestions for protecting your active solar investments so you have the best protections against any future changes to the tax credit rules:

For Projects Already Under Development:

Safe Harbor by EOY 2025

Safe Harbor is a tax provision that allows a solar project that has already undergone significant development to lock in its tax credit under the current tax law, protecting the project from economic challenges that could result from a change in tax code. This means that Customers that sign contracts and spend 5% of the total project costs by the end of 2025 (the easiest compliance pathway) should be able to secure the current 30% tax credit based on FY 2025 rules, even if congress votes to eliminate or decrease the tax credit for FY 2026 and beyond.

Resonant recommends that projects currently under development sign contracts by ~October 2025 in order to ensure that equipment can be ordered before the end of the year to meet this 5% threshold. We are also recommending that clients aim to spend 10% of the total development cost by the end of the year so there is flexibility for the project size and cost to change thereafter if needed, without risking falling out of compliance with the 5% threshold.

For Early Stage Projects: Letter of Intent

For projects that are fairly early in their solar journey, we recommend working to get a Letter of Intent (LOI) signed by July 2025. The LOI allows our team to get started with many of the important first steps in the solar design process including finalizing designs through a site visit and applying for interconnection. These steps need to be completed before equipment can be ordered and they can take some time, so it’s important to get the process started early enough so we can ensure that we are ready to order equipment in time to Safe Harbor the tax credit by EOY.

Safe Harbor Detailed Information

If you are interested in the details of the Safe Harbor provisions for solar tax credit policy, here is some additional background information:

The premise behind the idea of “safe harbor” is for congress to be able to provide a predictable means of determining if a project “started” in a given tax year under the rules applicable to that year. Given how long clean energy investments take to permit and develop (especially at the utility-scale size range where development timelines can run in the 4-10 year range), the only way investment can flow into these projects is if there is predictability around the pathway to getting federal tax credit support (the single largest incentive for clean energy projects nationally for the past 20 years).

On December 18, 2015, President Obama signed the Consolidated Appropriations Act, 2016 (the "Omnibus Bill"). The Omnibus Bill notably included key new rules about how taxpayers could Safe Harbor the solar investment tax credit (IRC Section 48). In May 2016, the IRS issued Notice 2016-31, 2016-21 I.R.B., which further clarified the rules.

Safe Harbor Tests for “Construction Commencement”

The Physical Work Test - this pathway requires starting construction at the site. This is often used by large scale clean energy developers who can start clearing or grading land, but is not as easily applicable to smaller-scale solar projects like the ones Resonant develops.

5% Safe Harbor Test - this pathway requires expending at least 5% of the total cost of the project. Notably, this is typically not satisfied by just paying a provider like Resonant through an EPC contract, but also requires providers to in turn expend those funds on things like equipment specific to that project. Inverters or modules are the most common pieces of equipment purchased by solar providers in these circumstances. As noted above, Resonant recommends 10% instead of 5% be spent in this way to provide system size / price flexibility later in the development process.

How long does Safe Harbor Last for?

Once a project has satisfied a safe harbor test in a given fiscal year, the project must be completed within 4 calendar years thereafter, which for smaller projects like the ones Resonant develops, is typically not a concern.

Source: Norton Rose Fullbright article on Safe Harbor.

Elective Pay Detailed Information

Resonant supports many nonprofits that are investing in solar projects on the basis of the current Elective Pay provisions that allow tax exempt entities to get a check in lieu of a tax credit for their solar projects. As noted above, we have reason to believe that this provision of the tax code may be eliminated or partially rolled back by Congress in 2025 (partial elimination could, for instance, limit eligibility to just 501c3 entities and remove the ability for public / tribal entities). Regardless of how this unfolds, our best advice at this stage is to rely on the safe harbor rules. Given this risk, we believe that tax exempt entities considering solar ownership as a pathway should be especially motivated to take action right away based on the guidance in this article to meet one of the safe harbor tests in FY 2025.

Why are MA Energy Costs rising? And how can you protect yourself?

By Rachel Gentile

Utility prices are increasing at an alarming rate, leaving customers on the hook for massive energy bills. In February, the Department of Public Utilities ordered the utilities to reduce costs to natural gas customers by 5%. Earlier in March, Governor Maura Healey announced a new “energy affordability agenda” which includes $50 electricity bill credits for all residential customers, a total of $125 MM redirected from funds collected to support clean energy.

Massachusetts is known for its high electricity prices, claiming the title for the third-highest residential electricity price in the nation in 2023. According to a report by the American Council for an Energy Efficient Economy, Boston has one of the highest energy burdens in the country. Some of our lowest-income residents are spending as much as 20% of their monthly income on energy costs, perpetuating the poverty cycle.

Massachusetts’ Unique Energy Challenges

Supply

Massachusetts’ dependence on electricity and natural gas imported from other states makes our electricity rates particularly susceptible to price spikes. Massachusetts is one of the most densely populated states in the country and we use a lot of energy. In recent years, Massachusetts has consumed twice as much energy as it produced, requiring additional electricity to be brought in via the regional grid, contributing to price volatility.

New England imports 5-6% of its electricity from Canada (primarily hydropower), which will be subject to tariffs recently put into place by the Trump Administration. Governor Healey was recently quoted saying that these tariffs could raise electricity costs by more than $200 million per year in the Bay State. A new hydropower transmission line, New England Clean Energy Connect, is expected to go online next year and will meet 20% of the Bay State’s electricity needs, which the Healey Administration expects will save ratepayers about $50 million annually.

There are challenges for the electricity we produce in-state as well. In 2023, 63% of Massachusetts’ in-state electricity generation came from natural gas plants. Since Massachusetts does not have any natural gas reserves or production, all of this fuel is brought in either by pipeline or as liquefied natural gas (LNG) in ships – in fact, the LNG terminal in Everett, MA is responsible for 87% of LNG imports nationwide. Since a significant amount of this gas is imported from overseas, these fuel resources are more susceptible to tariffs and supply chain-disrupting events. A prime example of this phenomenon can be seen in the chart below, when prices skyrocketed after the war in Ukraine broke out in 2022.

Delivery

Is MassSave the reason prices are so high?

Many critics have scapegoated the MassSave Program, the Commonwealth’s award-winning energy efficiency program, as the culprit for rising utility costs. MassSave’s budget is funded through delivery charges on customer bills, which have gone up substantially in recent years, and while the program is certainly a contributor to the current cost crisis, it is not the main driver of energy bill cost increases. In the long term, the energy efficiency measures supported by MassSave reduce customers’ energy bills. According to the Conservation Law Foundation, the recent $500 million cut to the MassSave program spurred by these rising costs will result in an almost $1.5 billion loss in benefits and cost savings to residents of the Commonwealth.

A narrow focus on the unit cost of electricity ($/kWh) can be misleading. As noted above, Massachusetts has the third highest $/kWh price of electricity in the country, but our per capita annual energy prices are quite low, 35th out of all states per the EIA. At $4,842 per year, our average per capita energy cost in Massachusetts is nearly 30% lower than what it is in Texas ($6,748), even though we have colder weather. This lower per capita energy cost can be directly attributed to statewide investments in MassSave and the solar incentive programs which reduce energy demand.

Utility Profit

In addition to funding state-mandated programs like MassSave, delivery charges cover the cost of building and maintaining infrastructure. These infrastructure projects are where utilities generate profit since electricity supply rates are set by the electricity wholesale market. Movements to increase resiliency through energy efficiency and distributed energy resources like solar reduce the need for traditional infrastructure investments. A recent study by the Maine Public Utilities Commission found that in 2023, the state’s net energy metering policy for distributed energy resources saved ratepayers $30 MM., By eliminating the need for new investments in the distribution grid by utility companies, these programs directly threaten utility companies’ profit. This helps to explain why utility companies like Eversource are willing to pay for lobbyists to call the benefits of these programs into question.

Opportunities to Reduce Your Energy Burden

For those of us who can’t afford lobbyists, it might feel like this energy system is too large and complex to disrupt, but there many ways that working people, small businesses and nonprofits can build energy independence. And the economics are on our side.

On-Site Solar

One of the most impactful ways for an organization to insulate itself from rising energy prices is to install on-site solar power, either through direct ownership or a no-cost power purchase agreement (PPA). In mid-2024, small-scale solar, including rooftop projects and small parking canopies, accounted for two-thirds of the solar capacity deployed in Massachusetts – yes, even more than those large utility-scale projects you see on the side of the highway. Under the new SMART Program (Solar Massachusetts Renewable Target), many of these smaller projects will benefit from higher state incentives, making solar even more affordable.

Solar ownership dramatically reduces the amount of electricity that your organization needs to buy from utility companies, protecting you from rising prices. If your solar array produces more energy than your building uses, like on a sunny summer day, you will receive credits on your bill. These bill credits can offset the electricity you use when the solar panels are not producing enough electricity, like at night. Credits from excess electricity can also be used to cover utility delivery fees, resulting in regular “No Payment Due” electric bills.

In a no-cost PPA, an organization contracts with a third-party financier who installs and owns the solar panels on their roof in exchange for discounted electricity. With a PPA contract, you lock in an electricity rate with a fixed yearly price escalator, usually 1%. In recent years, electricity rates have risen far faster than 1% per year with a national average rate increase of 3.6% in 2024, outpacing inflation. While the overall cost savings for a PPA are lower than solar ownership, it is a great option for cash-strapped organizations that still want to insulate themselves from rising utility costs, but without any upfront costs.

Finding Available Rebates and Incentives

Residents, businesses, and nonprofits can all benefit from the state’s energy rebates and incentives, like MassSave and SMART. If you haven’t yet, it’s a good idea to utilize the energyCENTS: Commonwealth Energy Tool for Savings tool to find out what kind of incentive or services you qualify for. As previously discussed, you’re already paying for these programs in your electric bill so you should take advantage of all cost savings available.

Sign up for Municipal Competitive Supply

Many municipalities in Massachusetts, including Boston, have created competitive supply programs, also known as Community Choice Aggregation (CCA). These programs allow the municipalities to negotiate electricity supply prices for residents and businesses which typically provides customers with lower and more stable pricing than the basic utility rate from National Grid or Eversource. Your electricity is still delivered the same way and your electricity bill will still come from the utility, but your $/kWh price will be set by your municipality’s competitive supply contract.

Talk to your lawmakers

Lastly, it may seem small, but talking to your lawmakers can make a difference. Public outcry following high prices in February led lawmakers to order changes from the DPU. We may be beholden to a large and unwieldy energy system, but that does not mean consumers are powerless.

Take action today to protect your organization from rising electricity rates and understand your building’s solar capacity and potential savings. Reach out to us here.

Solar Strategy in the Next Trump Era

As an organization, Resonant Energy is dedicated to fighting climate change through a just clean energy transition and Donald Trump has given ample reason to believe that his administration will be sprinting in the opposite direction on many different fronts. If you are looking for some answers and direction for what the new administration means for your solar project, you’ve come to the right place. This article is designed to equip you with the knowledge to make an informed assessment about the risks and opportunities for solar in the coming years.

Like many of you, I have been reflecting on the election, processing the disappointment, and getting my arms around the new uncertainty for our work in clean energy and the work of many of our community-serving partners. As an organization, Resonant Energy is dedicated to fighting climate change through a just clean energy transition and Donald Trump has given ample reason to believe that his administration will be sprinting in the opposite direction on many different fronts. A recent analysis indicates that his administration could dramatically increase U.S. emissions in the coming years at a critical time when we need to be taking unprecedented steps to mitigate the harm we are causing to the planet and to ourselves. Writing this on the warmest day in November in Boston in my lifetime with a dramatic drought underway makes this loss feel all the more poignant — and raises the stakes for our continued work together.

If you are looking for some answers and direction for what the new administration means for your solar project, you’ve come to the right place. This article is designed to equip you with the knowledge to make an informed assessment about the risks and opportunities for solar in the coming years. If you have further questions after reviewing, please don’t hesitate to reach out.

Sincerely,

Isaac Baker, Co-CEO

Resonant Energy

Executive Summary

What’s Potentially At Risk:

Federal tax credits and their associated transferability and elective pay (a.k.a. direct pay) rules are the only significant things at risk for solar.

We are especially concerned about the longevity of the low-income communities bonus credit program.

The only way to change this will be with congressional approval through a 2025 tax overhaul.

18 House Republicans have already come out in favor of protecting clean energy tax credits, like the baseline 30% tax credit for solar (August ‘24)

House Speaker Mike Johnson has said they will use a "scalpel and not a sledgehammer” when considering rolling back the Inflation Reduction Act (Sept ‘24).

What’s Generally Not At Risk:

Everything else that impacts your solar project’s economics – including high electricity costs, high state incentives with MA’s new SMART program, $27B in EPA Green House Gas Reduction Fund grant and loan programs, and the continued increase in state/local ordinances requiring onsite clean energy and/or overall green house gas reductions in buildings.

What To Do In Response:

Take Action Now for LI Bonus Credits: If you have a project that’s in a low-income census tract, on tribal lands, is a federally designated affordable multifamily development or plans to share power with low-income residents through community solar, the most important step you can take is starting your solar project with a Letter of Intent (LOI) by Jan 2025 and setting a goal to sign a contract by June 2025 so you can apply to lock in your bonus tax credit in Q2.

Key Notes:

once awarded, you have 4 years to build the project.

Even this Q2 timeline is potentially at risk and is not guaranteed

Tariff Related Cost Increases: Hold a contingency (5-10%) in your solar budget for some tariff related cost increases in the coming years.

The More Detailed Analysis

New Areas of Uncertainty

When it comes to assessing risk during Trump’s presidency, the main uncertainty for solar comes with anything that has federal jurisdiction. Within that, the questions are A) what can he do through executive action and B) what he can do only with congressional approval – and specifically what margins he’ll need to pass something. What we already know is both that Project 2025, a mile-long wishlist of Republican policy goals, calls for the full repeal of the Inflation Reduction Act (IRA), which would be devastating for our work if enacted; however, we also know that the IRA has many popular provisions that we believe are unlikely to be removed. House Speaker Mike Johnson has already said they will use a "scalpel and not a sledgehammer” when considering rolling back the IRA (Sept ‘24). We expect the tight margins in the House and targeted Republican support for solar to be our best protection against a larger repeal, which is likely to be considered as part of a tax reform bill in 2025.

Below we’ve provided our take on the risks to the key drivers for federal solar investment. Please note that we are providing this information to inform you in making an educated decision about your project and cannot provide a guarantee for any of this information. These conclusions represent our best expectation based on our research and that of the policy experts in our industry nationwide.

IRC Section 48 - Investment Tax Credit (ITC)

The ITC has been set for solar PV to a baseline of 30% for all non-residentially-owned solar projects – ranging from solar on a local food pantry all the way up through a seven-square mile utility scale solar farm. The incentive is set through 2032.

Resonant Assessment: Low Repeal Risk

Cannot be changed without congressional action, which at minimum would require a simple majority in the house and senate to pass through the budget reconciliation process. This process is how the Inflation Reduction Act (IRA) passed under Biden in 2022.

While Project 2025, a potential blueprint for the Trump administration’s actions, calls for the complete repeal of the IRA (Source, p.696), 18 House Republicans have already asked Speaker Johnson to protect clean energy tax credits specifically, which is driving significant clean energy investment and job growth in their districts.

Additionally, because this tax credit is used on large utility-scale projects in addition to the relatively smaller projects Resonant develops with aligned partners, there are billions of dollars of institutional investment at stake nationally relying on this credit. These larger projects are backed by banks and other large financial groups that will lobby hard to keep this credit in place — a lobbying source we see likely to be more successful with Republicans than claims from the industry.

Lastly, it’s worth noting, as well, that there is a long precedent for a solar investment tax credit through the last 15 years of presidential administration. The Investment Tax Credit was active during Trump’s first administration, 2016-2020, and he even approved extending the tax credit at 26% for two years as a part of spending packages that went through at the very end of his presidency (source).

Elective Pay (Direct Pay) and Transferability

Resonant Assessment: Medium Risk

One possible intermediate form of rollback would be the elimination of some or all of the transferability and elective pay rules, which have made it possible for organizations with little or no tax liability to still benefit from solar tax credits. These are policies that Resonant will be watching closely given their particular benefit to the nonprofits and public entities that we serve.

Eliminating these provisions may be a way for Republicans to keep the tax credits but reduce some of the costs

We expect that if lawmakers take this route, it will be on a go-forward basis

To best mitigate this risk, our recommendation is for nonprofits to move forward with installation this year in order to have the best chance of accessing the tax credit. There are a lot of unknowns and it is ultimately up to a nonprofit’s board to asses the risk and make the best decision for your organization.

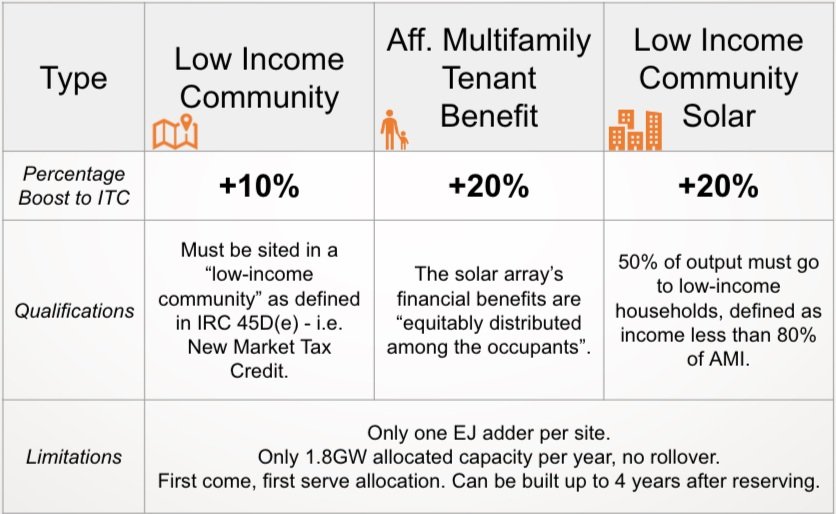

Low-Income Communities Bonus Credit Program

This program competitively offers 10-20% bonus tax credits for projects through 2032 that meet equity-oriented goals for solar deployment on top of the baseline 30% credit value. Eligible recipients include any project located in a low-income zip code (Category 1), projects on tribal lands (Category 2), federally designated affordable housing (Category 3), and low-income community solar (Category 3). The program allocates awards through an annual application process, expected in Q2 of each year. Resonant Energy has helped hundreds of multifamily buildings and nonprofits qualify for bonus credits in FY 2023 and 2024 with a 70%+ acceptance rate.

Resonant Assessment: Medium-High Repeal Risk

Cannot be changed without a congressional majority via budget reconciliation.

However, unlike the base 30% tax credit, these bonus credits are only available for smaller projects < 5 MW-AC. As such, they will have a smaller Wall Street constituency and have an explicit equity-oriented mandate that we think may make it an easier target for a Republican cut.

The policy’s only likely protection is that it applies to 1.8 gigawatts of solar projects each year, representing $4b - $5b in tax credit value, which groups invested in this value stream will advocate to protect.

This program offers a non-competitive 10% bonus tax credit for projects that meet 40-55% (ramping up from 2023-2027) domestic content thresholds for the “manufactured goods” included in a given solar project. This applies to the modules, inverters, electronics, and racking. This triggers prevailing wage over 1 MW-AC, but most projects we work on are below that size. Separately, all projects receiving federal funding, like Solar for All or Green House Gas Reduction Fund, will be required to comply with Build America Buy America (BABA), which requires 55% domestic content. This BABA requirement will make all federally funded projects e eligible for the Domestic Content bonus credit.

Resonant Assessment: Low Repeal Risk

Cannot be changed without a congressional majority via budget reconciliation.

Given the Trump campaign’s focus on American manufacturing, the billions of dollars that has been invested in new American manufacturing capacity (especially in red states like Georgia and Texas), we believe that this credit is unlikely to be removed.

Some companies like Sunnova (a residential solar financing company) are especially confident in the durability of this provision and have repositioned their business strategy around domestic content compliance.

Energy Community Tax Credit Bonus

This program offers a non-competitive 10% bonus tax credit value to projects that A) are located near retired fossil fuel generation or extraction locations, B) are located in census tracts with high rates of historic fossil-fuel related employment and current unemployment or C) are on land that is designated as a brownfield site for non-petroleum contamination.

Resonant Assessment: Low Repeal Risk

Cannot be changed without a congressional majority via budget reconciliation.

The drafting of this provision was heavily influenced by Joe Manchin and disproportionately benefits red states like West Virginia. Because of this, we believe it’s unlikely to be repealed.

Note: It rarely benefits projects in New England, but is occasionally relevant. You can check eligibility with our mapping tool here.

Tariffs on Clean Energy Equipment

Trump has set an intention to add 10-20% tariffs on all imports and 60% tariffs on imports from China (source). Solar cells / modules already have a 50% tariff as of 2024, which was doubled from the previously set level by the Biden administration (source).

Resonant Risk Assessment: Some Tariffs Likely, Lower Economic Impact

Tariffs to some degree can be implemented unilaterally by the President (source). However, tariffs on all goods from China and all other countries for that matter would likely be seen as so broad that it would require congressional approval. It remains to be seen how Trump will proceed and how whatever he does will stand up to a legal challenge.

Regardless of its success, the reality for smaller distributed scale solar projects on the ground is likely to be modest. Given the existing tariffs, all projects we’re working on currently expect to use panels from non-China sources in Southeast Asia (e.g. South Korea, Vietnam, etc) and we expect more domestically produced modules to become broadly available by 2026.

Panels typically represent ~20% of the cost of a project we work on. A 20% increase to this line item represents a 4% cost increase for the overall project.

While cost isn’t the biggest concern, we are monitoring supply chain availability for key components like transformers or meter sockets, which has been constrained due to the massive increase in demand in recent years. Tariffs can create short-term “hoarding” problems where larger companies buy up a lot of an item in advance of implementation, which can limit availability to others in the marketplace.

Areas Unlikely to be Impacted by a Trump Presidency

Greenhouse Gas Reduction Fund (GGRF) Grants & Loans: A massive portion of the funding to support solar for affordable housing and EJ communities is being delivered through grant funding that has already been committed to state governments and nonprofit coalitions. In anticipation of a potential Republican sweep, the EPA rushed to award $20 billion in funding through the NCIF and CCIA programs (focused on loans and market transformation) and $7 billion through the Solar for All program (focused on grants). Funding recipients have reason to believe this funding is secure and are setting about creating new grant and loan products available for equity-oriented clean energy projects, which we expect to launch in 2025 and run through 2029.

State Cash Incentives - MA SMART 3 Program: The SMART successor program (aka SMART 3) is the latest program from MA’s Department of Energy Resources (DOER) that will offer 10-20 years of monthly cash payments to solar system owners based on system size and will include equity and siting oriented “adders” that many of our clients will benefit from. This program promises to significantly increase the economic value of solar projects in MA starting in mid-2025 and has no risk associated with the Trump administration.

State and Local Solar Requirements - Whether it is the new MA Stretch Code, the Passive House (PHIUS) effective requirements for new affordable housing, the new emissions reductions standards in Boston or Cambridge for all commercial buildings, or the solar specific ordinances like we have in Watertown, we are seeing continued local leadership requiring on-site clean energy for both new and existing buildings. We believe we will continue to see continued adoption of these measures and ultimately expect further statewide rollout after sufficient piloting in progressive eastern MA cities and towns.

Electricity Savings: The most obvious benefit of solar is offsetting your electricity costs, which have risen dramatically in Massachusetts since the pandemic, landing it in the top 5 states for electricity costs in the U.S. (source). There are two primary factors that influence electricity costs – both of which we expect to continue to increase:

Energy Supply Costs: these costs vary and in New England are heavily influenced by the cost of Natural Gas, which supplies ⅔ of MA’s electricity generation (source). Coming out of the pandemic, costs have already dropped significantly. It’s possible that a highly pro-drilling Trump administration could unlock much greater domestic energy production, increasing supply. However, this administration is likely to reverse Biden’s course and approve additional liquified natural gas (LNG) export facilities, enabling producers to access more markets, increasing demand. How this will all play out remains to be seen and, as in the past, there will likely continue to be volatility in this market.

Takeaway: the current outlook does not offer clear evidence for anything other than continued volatility with many supply/demand factors influencing New England energy markets.Transmission & Distribution (T&D) Costs: These are the costs paid to the utility for maintaining the poles and wires. When you install solar on-site, you typically can offset most or all of these charges as well, depending on your utility rate class and overlap with demand charges. Utilities make money primarily by investing in new infrastructure and getting a guaranteed rate of return on the capital through these T&D charges (a recent Vox article offers a helpful breakdown). As society electrifies and experiences more extreme weather, utilities are taking on many new responsibilities and costs, which they are passing on to consumers via T&D charges that have been going up much faster than inflation.

Takeaway: we expect continued T&D cost increases at a pace faster than inflation for commercial customers in MA.Net Metering Policy: Net metering policy, allowing solar to get credit for offsetting some or all of the charges listed above, is set at the state level and will not be impacted by a Trump administration.

Resonant’s Solar Strategy Recommendations

Take Action Now for LI Bonus Credits: We are most concerned about the potential loss of the Low-Income Communities Bonus Tax Credit program, which could be eliminated through a budget reconciliation process in 2025 for FY2026 and beyond. As such, if you have a project that’s in a low-income census tract, on tribal lands, is a federally designated affordable multifamily development or plans to share power with low-income residents through community solar, the most important step you can take is starting your solar project by January 2025 and setting a goal to sign a contract by June 2025 so you can apply to lock in your bonus tax credit in Q2.

Key Notes:

once awarded, you have 4 years to build the project.

Even this Q2 timeline is potentially at risk and is not guaranteed

Tariff-Related Cost Increases: Hold a contingency (5-10%) in your solar budget for some possible tariff-related cost increases in the coming years (and likely do the same for many of your other construction line items).

Remember that Solar Is Resilient and Supported by Many Sources: The momentum moving behind solar is strong and the majority of the lifetime value for projects comes from local sources (state, municipal, utility) that Trump and his congressional colleagues will not have influence over.

Additional Resources:

Norton Rose Fulbright - Renewables Under Trump discussion transcript (Sept 2024)

Canary Media - How Trumps Second Administration Could Derail Clean Energy Transition (Nov 6, 2024)

Power Brief & Crux - Election Impact on Transferability Market (Nov 2024)

Senator Ed Markey Announces New Green Business Loan Programs at Resonant Solar Site

Senator Ed Markey and Administrator Isabel Casillas Guzman of the US Small Business Administration (SBA) visit affordable housing solar site in Dorchester to announce new green business loans.

On July 22, 2024, our team had the privilege of welcoming Senator Ed Markey and Administrator Isabel Casillas Guzman of the US Small Business Administration (SBA) to one of our affordable housing solar projects in Dorchester.

The Indigo Block solar array

Indigo Block is a new construction development in Upham’s Corner, owned by Dorchester Bay Economic Development Corporation. The solar system, installed in August 2022, is offsetting 33% of the building’s common area usage which includes elevators, hallway lights, and community rooms. The housing development is expected to generate $420,000 in net financial benefit over the lifetime of the system.

The Senator and Administrator were announcing a new Green Lender Initiative to enroll additional climate lenders in SBA’s loan programs. The initiative will employ SBA loan guarantees to attract additional private capital in support of clean energy investments spurred by the Inflation Reduction Act.

Resonant Energy co-founder Isaac Baker spoke to Senator Markey's leadership in passing the Inflation Reduction Act that has enabled our rapid expansion of solar for affordable housing and nonprofits across MA and our enthusiasm for the forthcoming Greenhouse Gas Reduction Fund and SBA funding that will continue to increase uptake.

From left: Kimberly Lyle, CEO of Dorchester Bay Economic Development Corporation, City Councilor Brian Worrell (District 4), Isaac Baker, co-CEO of Resonant Energy, Rep. Christopher Worrell (Suffolk), and Senator Ed Markey

Isaac and Senator Markey joined by Resonant staff members Colby Lawless (Account Manager) and Joanna da-Cuhna-Semedo (Sr. Environmental Justice Program Manager)

Read more about the Senator’s Announcement

Senator Markey, Administrator Guzman Announce Biden-Harris Administration SBA Loan Programs to new green lenders to help small businesses meet climate goals - Senator Ed Markey’s Office

Markey touts new clean energy business initiatives in Boston - Boston 25 News

Resonant Energy’s Recommendation for the Future of Massachusetts Solar Incentives

By Ben Underwood and Rachel Gentile

The first iteration of the Solar Massachusetts Renewable Target (SMART) program is ramping down, and the Department of Energy Resources (DOER) is currently soliciting comments from industry stakeholders to inform the program’s successor. This is an excellent opportunity for DOER to address some of the shortcomings of SMART and its predecessor SREC, primarily the insufficient incentives for low-income solar which have failed to spur widespread adoption.

Of 478 MW of small (<25 kW AC) systems enrolled in the SMART Program to date, only 21 MW or 4.4% are Low-Income Solar Tariff Generation Units (LI STGU). For context, roughly 34% of households in the state have incomes below $50,000 and would likely qualify as Low-Income Customers under current SMART guidelines. The vast majority of program participants are owners of non-low-income systems. Because of the program’s “declining block” structure, whereby the value of incentives decrease as more participants enroll in the program, this has decreased the SMART value available to LI STGUs without proportionately benefitting low-income customers.

Ensuring equity in the clean energy transition is critical. Low-income neighborhoods have historically been the target of predatory energy suppliers and many of these residents already face a high energy burden. To ensure that more low-income residents can participate in the clean energy transition, Resonant Energy submitted the following recommendations to the DOER.

1. Resetting Compensation Rates

The compensation rate for Low-Income Solar Tariff Generation Units (LI STGUs) should be reset to a minimum of $0.40/kWh to provide a stable and effective incentive for low-income participation. This rate should be exempt from the program's declining block values to ensure long-term benefits and accessibility for these customers.

2. Enhancing Consumer Protection

To protect low-income consumers, we’re advocating for a guaranteed 10% annual bill savings for participants in third-party-owned systems. These savings should be guaranteed for the full contract term, typically 20 - 25 years. We believe these changes would make solar investments both safer and more appealing to low-income households.

3. Expanding Eligibility Definitions

We recommend that the DOER expands the definitions for LI STGUs and Low-Income Property Solar Tariff Generation Units (LIP STGUs) to more accurately reflect the diverse sources of affordable housing that exist across the Commonwealth: The definition of LI STGU should be expanded to include any small property that cannot host more than 25 kW of capacity so long as it meets the other qualification requirements of a LIP STGU. And the definition of LIP STGUs should be expanded to include any system with a rated capacity greater than 25 kW that provides all of its generation output in the form of electricity or bill credits to:

low or moderate-income housing, as defined under M.G.L. c. 40B

condominiums that are deed-restricted to provide low-income home ownership or rental opportunities

homeless shelters

a residential rental building that participates in a covered housing program as defined in section 41411(a) of the Violence Against Women Act of 1994 (34 U.S.C. 12491(a)(3)

a housing assistance program administered by the Department of Agriculture under title V of the Housing Act of 1949

a housing program administered by a Tribally designated housing entity as defined in section 4(22) of the Native American Housing Assistance and Self-Determination Act of 1996 (25 U.S.C. 4103(22)

Other affordable housing programs as the DOER may see fit

Not only would these changes allow more types of affordable housing to be covered under the SMART successor program but it would also align the state definition of “low-income property” with the definitions used under the federal Inflation Reduction Act. This would help reduce complexity for low-income housing providers and help ensure that more low-income solar can be built in Massachusetts.

4. Streamlining the Allocation of Benefits with Electric Distribution Companies (EDCs)

We recommend requiring EDCs to share lists of meter numbers associated with low-income properties with owners of eligible low-income solar arrays. These low-income systems should further be enabled to allocate credits using meter numbers instead of utility account numbers, thereby reducing the administrative burden of updating those numbers when a tenant moves. If credits are allocated to a meter associated with a low-income restricted unit, the system owner only needs to assign the credits once.

Lastly, the DOER should allow LISTGUs to be sized according to the total usage of multifamily properties so long as they allocate a minimum benefit to each tenant, therefore eliminating the need for these systems to restrict their size to common area usage, and making the most of available roof space.

Implications and Impact

Implementing these recommendations has the potential to significantly impact low-income communities, reducing energy burdens and increasing participation in solar energy programs. This approach not only addresses immediate equity concerns but also contributes to Massachusetts' broader sustainability and climate goals. The movement towards equitable solar energy in Massachusetts is more than a policy shift; it's a commitment to justice, sustainability, and community empowerment. By prioritizing inclusivity and equity in solar energy access, the state can serve as a model for others, demonstrating that the transition to renewable energy can and should benefit everyone. We welcome input from you, our community, on how our recommendations could be improved. And we would love your help if you would like to join us in advocating for the speedy adoption of these improvements. Together, we can light the way to a brighter, more sustainable future for all Massachusetts residents.

Suggestions or feedback can be sent to info@resonant.energy

Inflation Reduction Act: End of Summer Policy Update

NOTE: Since the original publication of this blog, the IRS has announced that the application for the Bonus Low-Income Tax Credits will open on October 19, 2023. Learn more here

As the IRS has released the final guidelines for the various tax credits under the Inflation Reduction Act, our team has been diving deep into the policy. Below is a high-level update on the most relevant policies for low-income solar and affordable housing. If you’re just wading into the ocean that is the IRA, we’d suggest checking out our previous explainers on the IRA for Nonprofits and our June 2023 IRA update. This blog post will clarify some of the new information that has come out since our last update.

Support from Resonant Energy

We cannot cover every policy detail in this blog post and there is much more to unpack. Existing clients can reach out to their business development representative for more specific questions about your project. We will also provide clients with a more detailed breakdown of all of the relevant policies.

Resonant Energy will work with all of our clients to ensure they have a pathway to access the highest possible federal tax credit incentives to support their projects. We will outline where applications have a greater or lesser chance of approval, estimated timelines for next steps, and financial implications for how the project can be financed under different scenarios. Once the Treasury makes the portal available, Resonant Energy will work to either submit applications on clients' behalf or to prepare all submission documentation for clients to submit directly if that is required.

Total Potential Tax Credit Value:

Between all of the applicable tax credits, solar projects will be eligible for up to a 70% Investment Tax Credit or Direct Payment. However, unless the project is an affordable multifamily housing project, built with domestically manufactured components and located near a decommissioned coal power plant, or another equally specific scenario, it will likely qualify for a lower tax credit. We expect most projects to fall into the 30-50% range.

Guaranteed Adders (No Application Required)

Energy Community (10%)

The Energy Communities Adder automatically adds 10% to the tax credit if a project is located in one of the following:

Brownfield Site (note: must have contamination not solely from petroleum).

Census tracts near current/former coal-fired power plants

Census tracts with a high rate of employment in the energy sector and high rates of unemployment (e.g. all of West VA).

You can determine if a particular census tract qualifies for the Energy Community Adder here. Resonant Energy is creating our own EJ Map that will incorporate both the Energy Community Adder and the Low-Income Bonus Tax Credit — stay tuned!

Domestic Content (10%)

We have some clarification on what is required to qualify for the domestic content adder. First, any steel and iron used in the racking for the project must be made in the US. Additionally, the total domestic content percentage must meet the increasing scale of minimum domestic content requirements (below), starting at 40% in 2023 and rising to 55% by 2027. The total domestic content percentage can be calculated by dividing the cost of domestically manufactured products and components used in a project by the total cost of materials (both domestically and internationally manufactured). The cost of US-manufactured steel and iron can be included in this calculation, which, given the price of steel, makes most canopy projects eligible for this adder.

Bonus Low-income Tax Credits (Application Required)

The Low-income bonus tax credits can be combined with both the domestic content and Energy Community Adders but a project can only apply for one of the LI tax credits. Below is a summary table of the different low-income bonus tax credits. If you’re looking for a more in-depth overview of these tax credits, check out our previous IRA Update.

Additional Selection Criteria

In order to determine which projects win bonus tax credits, the Treasury has proposed new Additional Selection Criteria. Facilities that meet these criteria get priority in the tax credit allocation process. At least 50% of the capacity for each bonus tax credit category will be reserved for projects that meet one or both additional selection criteria, meaning that projects that meet the criteria will have a greater chance of receiving the higher tax credit.

The Additional Selection Criteria are bifurcated into ownership and geographic categories. Facilities that fulfill at least one requirement in each category will be given the highest priority; facilities that meet a requirement in one category (say, ownership but not geographic) will be prioritized above those that meet none of the requirements.

The ownership category includes structures such as Tribal Enterprises, Alaska Native Corporations, Renewable Energy Cooperatives, Qualified Renewable Energy Companies, and Tax-Exempt Entities. On the geographic front, the facility should be located either in a Persistent Poverty County (PPC) or in a census tract designated as disadvantaged based on specific percentile parameters for energy burden and low income which can be identified using this screening tool.

Application Timing

The application for bonus low-income tax credits will be open for a 30-day window beginning on October 19, 2023. There will be no first-come first-serve element to that window. Projects with one or two Additional Selection Criteria will receive priority and all other projects will be put into a lottery if oversubscribed.

For any categories that are not fully subscribed after the initial window, applications will continue to be reviewed on a rolling basis.

Conclusion

We’re excited to finally see the details of the IRA coming together. While we are still waiting on the exact timing from the Treasury on when the applications will open, we are excited to get to be able to provide clients and partners with the tools and resources they will need to make the most of this opportunity. The IRA is landmark legislation that is fundamentally changing the way low-income and environmental justice solar projects will be built in the US and we are eager to get started.

Existing Resonant clients can contact their business development representative for further guidance. If you’re ready to explore solar for your portfolio or have questions about these policies, reach out to us at info@resonant.energy and someone will reach out.

Profit with Purpose: Why Resonant Became a B-Corp

What is a B Corp?

Resonant is proud to be a Certified B Corp. B Corps, or Benefit Corporations, are for-profit businesses that prioritize both profit-making and positive social and environmental impacts. They undergo a rigorous certification process conducted by B Lab, a non-profit organization. B Lab assesses a company's performance in areas such as governance, employee treatment, community engagement, and environmental practices. B Corps aim to generate financial returns while considering the well-being of employees, communities, and the planet, making them impactful players in the business world.

To certify, Resonant shared company financials and submitted an extensive survey for each of the four B Corp performance areas (governance, employee treatment, community engagement, and environmental practices). Resonant also made explicit commitments to prioritize our mission. We have enshrined our commitment to prioritize people and planet alongside financial goals in our operating agreement/company bylaws.

Why is Resonant a B Corp?

Since our founding in 2016, social justice has been at the center of our work broadening access to solar energy and becoming B Corp-certified felt like a natural extension of that mission. Additionally, at its inception Resonant Energy chose to incorporate as a for-profit social enterprise rather than a 501c3 nonprofit so we could message that our work would seek to be self-sustaining rather than reliant on grants and contributions; having opportunities to demonstrate the ways in which the company is different from most other for-profit companies and committed to staying that way long term was another key factor driving the company’s choice to get certified.

We also learned that some master's degree programs like the Yale MBA offer a financial break on student loan payments to help incentivize its graduates to work for nonprofits, the public sector or B Corp-certified organizations. We hope this trend catches on more broadly!

Solar energy will not become more equitable without careful and intentional decision-making. Equity-focused projects are not always going to be the most profitable or the easiest projects to build; many nonprofit projects face hurdles like older building stock, challenges with financing, or insufficient technical assistance. We believe it is important to prioritize social and environmental impact just as much as profit to ensure that these types of projects are built. As a B corp, we are required to remain transparent about our business practices and regularly check in on our performance which helps keep us accountable to our mission.

What’s the value to the client?

Nearly all of our clients are mission-driven organizations and we consider our clients' missions an extension of our own. We want to help nonprofits reduce operating costs so they can devote more of their energy and resources to serving their communities. You don’t have to trust that we value environmental and social benefit as highly as profit – it’s all laid out in our B Corp Report Card.

Inflation Reduction Act Update: How to Qualify for Bonus Low-Income Solar Tax Credits

In the 10 months since President Biden signed the Inflation Reduction Act (IRA) into law, we’ve received many questions from clients and industry partners about how these new regulations will be implemented. On June 1, the Treasury issued its proposed rules on Low-Income (LI) tax credits, opening a new chapter in equitable solar energy distribution. These changes emphasize the critical intersection of affordable housing and solar power, tying them together with groundbreaking new tax credit incentives.

In the 10 months since President Biden signed the Inflation Reduction Act (IRA) into law, we’ve received many questions from clients and industry partners about how these new regulations will be implemented. On June 1, the Treasury issued its proposed rules on Low-Income (LI) tax credits, opening a new chapter in equitable solar energy distribution. These changes emphasize the critical intersection of affordable housing and solar power, tying them together with groundbreaking new tax credit incentives.

This post will be focused on the emerging rules for how to qualify for bonus LI tax credits under the IRA. Note that this post details proposed rules, which are open for public comment here until June 30. We expect the Treasury to publish final rules in the months to come. (In case you’d like to learn more about the IRA’s impact on nonprofits, check out our blog post from last fall.)

Environmental Justice Location Adder (10%)

The Treasury is describing projects located in a low-income community as Category 1 and projects located on Indian land as Category 2, both of which will be eligible for a 10% tax credit adder. The Treasury has set a 700 megawatt (MW) capacity limit for Category 1 projects, 560 MW of which will be reserved for single- and multi-family residential behind-the-meter (BTM) facilities under the proposed rules.

Low-income communities are defined as a census tract with a poverty rate of at least 20% or a census tract with an area median income (AMI) that does not exceed 80% of the state’s median income. In metropolitan areas, a census tract can also be considered a low-income community if its AMI does not exceed 80% of that metropolitan area’s AMI. You can check if an area qualifies for this adder using this map.

Financial Benefit to Tenants Adder (20%)

The Treasury has placed emphasis on delivering a "financial benefit" to tenants of affordable housing which will make systems eligible for an incremental 20% tax credit. This lies within the framework of the proposed rules under Category 3, which includes a 200 MW allocation. Broadly, at least 50% of the financial value of net energy savings needs to be equitably passed on to the tenants; the beneficiaries of these savings must be identified as low-income under an existing housing program.

The rules use distinct criteria for calculating the financial value of net energy savings for Direct Purchase (DP) and Third Party Ownership (TPO) projects:

Table 1: Net Energy Savings Calculation

Low-Income Community Solar Adder (20%)

Another exciting provision is the 20% bonus tax credit for "low-income benefit" projects. This falls under Category 4, with a 700 MW allocation and is tailored towards Low Income Community Solar Subscription (LICSS) projects.

To qualify:

At least 50% of the total output must be allocated to qualifying customers, defined as households with income below 200% of the poverty line or below 80% of area gross median income.

Subscriber savings must be equal to or greater than 20% of the value of the underlying Net Energy Metering (NEM) credit (e.g., Net Metering Credit (NMC), Alternative On-Bill Credit (AOBC), etc.)

Application Timing and Selection Process

To be eligible for any of the bonus tax credits, a solar system cannot be operational before the award of the credit. In order to determine which projects win bonus tax credits, the Treasury has proposed new Additional Selection Criteria. Facilities that meet these criteria get priority in the tax credit allocation process.

The Additional Selection Criteria are bifurcated into ownership and geographic categories. Facilities that fulfill at least one requirement in each category will be given the highest priority; facilities that meet a requirement in one category (say, ownership but not geographic) will be prioritized above those that meet none of the requirements.

The ownership category includes structures such as Tribal Enterprises, Alaska Native Corporations, Renewable Energy Cooperatives, Qualified Renewable Energy Companies, and Tax-Exempt Entities. On the geographic front, the facility should be located either in a Persistent Poverty County (PPC) or in a census tract designated as disadvantaged based on specific percentile parameters for energy burden and low income which can be identified using this screening tool.

Documentation for Bonus TC Allocation Application

The rules governing what documentation is needed to apply for the bonus tax credit allocation application are relatively complex (see table here for more details). For BTM facilities with <1 MW AC, here's a brief rundown of what’s needed:

A completed site visit

An executed DP contract or PPA contract

Building and electrical permits

Facility not designed to produce more than 110% of the historical customer load

Closing Thoughts

Equitable solar development is a pivotal part of the transition to renewable energy, and the proposed Treasury rules offer a glimpse into how the solar industry will change in the months and years to come. Understanding these rules helps us realize the immense potential of the IRA to bring about a fair and equitable energy future.

We are still waiting for guidance from the Treasury regarding other policies including the Direct Pay provision for nonprofit organizations. We will continue to work with our partners and policy experts to remain at the forefront of these new regulations and we look forward to updating you as more information becomes available.

For now, put your hand up and make your voice heard during the open comment period for the Environmental Justice provisions which runs through June 30. Together, let's continue to illuminate the path toward a more just and equitable energy system.

How the Inflation Reduction Act is Changing the Way Nonprofits go Solar

The Inflation Reduction Act (IRA) is the single largest climate investment that the US government has ever made. Signed into law in August 2022, the legislation includes $369 billion in funding for climate solutions and environmental justice initiatives, with the ultimate goal of reducing carbon emissions by 40% by 2030. A portion of this funding is going to support improved solar incentives that are dramatically changing the way nonprofit organizations can pursue solar.

Note: This article has been updated to reflect our evolving understanding of this legislation

By Rachel Gentile

The Inflation Reduction Act (IRA) is the single largest climate investment that the US government has ever made. Signed into law in August 2022, the legislation includes $369 billion in funding for climate solutions and environmental justice initiatives, with the ultimate goal of reducing carbon emissions by 40% by 2030. A portion of this funding is going to support improved solar incentives that are dramatically changing the way nonprofit organizations can pursue solar.

Why is this important?

After Congress failed to pass the Build Back Better Act at the end of 2021, a sense of uneasiness spread throughout the solar industry (and throughout the environmental movement). In order for the US to meet our climate goals set by President Biden, we are going to need sweeping clean energy legislation and the failure of Build Back Better felt like a crushing blow to many who were eagerly awaiting these policy updates. When the Inflation Reduction Act passed with long-term tax benefits for solar installations and significant boosts for projects serving environmental justice communities, there was plenty to celebrate.

Below, we will break down how some of these new policies are helping make solar more accessible for churches, community centers, affordable housing providers, and other nonprofit organizations serving their communities.

What is in the IRA?

Federal Investment Tax Credit Increase

The most straightforward provision in the IRA is a substantial increase in the federal Investment Tax Credit (ITC). When a homeowner or business invests in solar, they can claim the ITC on their taxes and receive a direct tax credit. Under the previous legislation, the ITC was valued at 26% of the total cost of the installed solar project and was set to step down to 22% at the end of 2022 (and 10% thereafter). The IRA is improving the tax credit dramatically by bumping the ITC up to 30% for the next 10 years. This increase is also retroactive for the 2022 year - any project that was built in 2022 and is now eligible for a 30% tax credit.

A higher ITC not only benefits nonprofits that own their solar array but also those choosing to install third-party-owned systems. Power Purchase Agreements (PPAs) are a great option for organizations that have capital constraints because they require no upfront cost, and the nonprofit organization is not responsible for any maintenance. With the additional revenue from a higher tax credit, Resonant is working with financers to offer more favorable PPA rates to both new and existing clients.

The ITC covers the entire upfront cost of your system, including all equipment and installation costs, meaning it effectively reduces the price of your project by 30%. Installing solar can sometimes require upgrades to utility infrastructure such as a new transformer. Previously, the cost of infrastructure upgrades could not be covered by the ITC, but now these upgrades can be included in the total project cost.

Direct Pay for Nonprofits and Other Tax-Exempt Entities

The most groundbreaking policy change for nonprofits is the addition of a Direct Pay provision. Previously, nonprofits and other tax-exempt entities could not take advantage of the tax credit, making owning your own solar array significantly less economical for nonprofits than for tax-eligible entities. These organizations could work with third-party financers to set up a PPA or a hybrid ownership option but both of these solutions saw lower lifetime savings than an ownership option.

Under the new Direct Pay provision, solar customers will be able to receive a cash reimbursement for the full value of the investment tax credit. The Treasury has not released an application or process for Direct Pay, but nonprofits that work with Resonant will have step-by-step assistance as we navigate this process together.

Environmental Justice Adders

In addition to increasing the base value of the ITC, the IRA has also implemented 3 environmental justice-focused incentive adders that can make a project eligible for up to a 50% tax credit. These benefits are designed to help address some of the barriers to equitable access for low-income residents and limited-resource communities. The details have yet to be finalized by the Treasury but we know that the total capacity for these benefits will be limited to 1.8 GW each year. We encourage organizations to contact us at your earliest convenience to see which incentives you qualify for.

Environmental Justice Location Adder (10%)

A project becomes eligible for an additional 10% tax credit if the project itself is located in a low-income census tract.

Affordable Multifamily Tenant Benefit Adder (20%)

A project that is located on a low-income residential building that is evenly distributing the electricity savings among tenants becomes eligible for an additional 20% tax credit. We are still waiting for more information on how this one will look and what the requirements will be

Low-Income Community Solar (20%)

Any project that is sending at least 50% of the output from its system to low-income households becomes eligible for an additional 20% tax credit. This is a great option for organizations with large roofs or parking lots but relatively low energy usage such as houses of worship.

The Treasury has until February 12, 2023, to finalize the guidelines and application process for these environmental justice adders. We expect that the application will require a signed contract and interconnection agreement with the utility company.

What’s Next?

The IRA is a complex piece of legislation with significant implications for solar across market segments. If you’re interested in a deeper dive into the details of this legislation, you can check out this recording from our webinar Solar for Nonprofits: New Policies, Big Benefits.

Organizations that are interested in taking advantage of these additional benefits but haven’t begun the pre-development process should reach out to info@resonant.energy with a copy of their electric bill. This will allow Resonant to get started with initial designs and contracting so that your project can be ready to apply for these exciting new benefits when the portal opens in 2023. We expect these programs will fill up fast so we want our clients to be the first in line.

For the first time, nonprofit organizations are fully empowered to take control of their own clean energy future. Though there is still some uncertainty about how all of these policies will be implemented, our team is feeling energized by the forward momentum in the clean energy industry. We are excited to continue working with nonprofits to find the ideal solar solution that best fits your financial needs while supporting your organization’s mission.

Resonant Energy’s “Solar Ready” Definition for New Construction

Resonant’s recent work with a number of affordable housing developers has made one fact increasingly apparent: early coordination is key for the successful implementation of solar energy in new construction. The term “Solar Ready” has been used in the past to communicate to builders and developers that solar design has been factored into building plans; however, the definition of the term can vary widely. In this blog post, we will dive into what solar ready really means, when to start planning for solar, and who needs to be involved as we continue our work to provide solar access and energy savings to our community.

Resonant’s recent work with a number of affordable housing developers has made one fact increasingly apparent: early coordination is key for the successful implementation of solar energy in new construction. The term “Solar Ready” has been used in the past to communicate to builders and developers that solar design has been factored into building plans; however, the definition of the term can vary widely. In this blog post, we will dive into what solar ready really means, when to start planning for solar, and who needs to be involved as we continue our work to provide solar access and energy savings to our community.

By Katherine Wagner

Resonant’s recent work with a number of affordable housing developers has made one fact increasingly apparent: early coordination is key for the successful implementation of solar energy in new construction. The term “Solar Ready” has been used in the past to communicate to builders and developers that solar design has been factored into building plans; however, the definition of the term can vary widely. In this blog post, we will dive into what solar ready really means, when to start planning for solar, and who needs to be involved as we continue our work to provide solar access and energy savings to our community.

KEY PLAYERS

At the start of a new construction project, there are many individual contributors to the final design. From the very beginning of a solar project, developers, general contractors, architects, engineers, electricians, plumbers, HVAC, and roofers are all involved in decisions made to make a project “solar ready.”

To help ensure that the building effectively includes solar design parameters, we suggest property developers consult Resonant once construction drawings are 50% complete. At this point in the process, we can address questions like, “What roof material is preferred,” “Where do I need to locate vents and HVAC to best reserve space for solar panels,” etc.

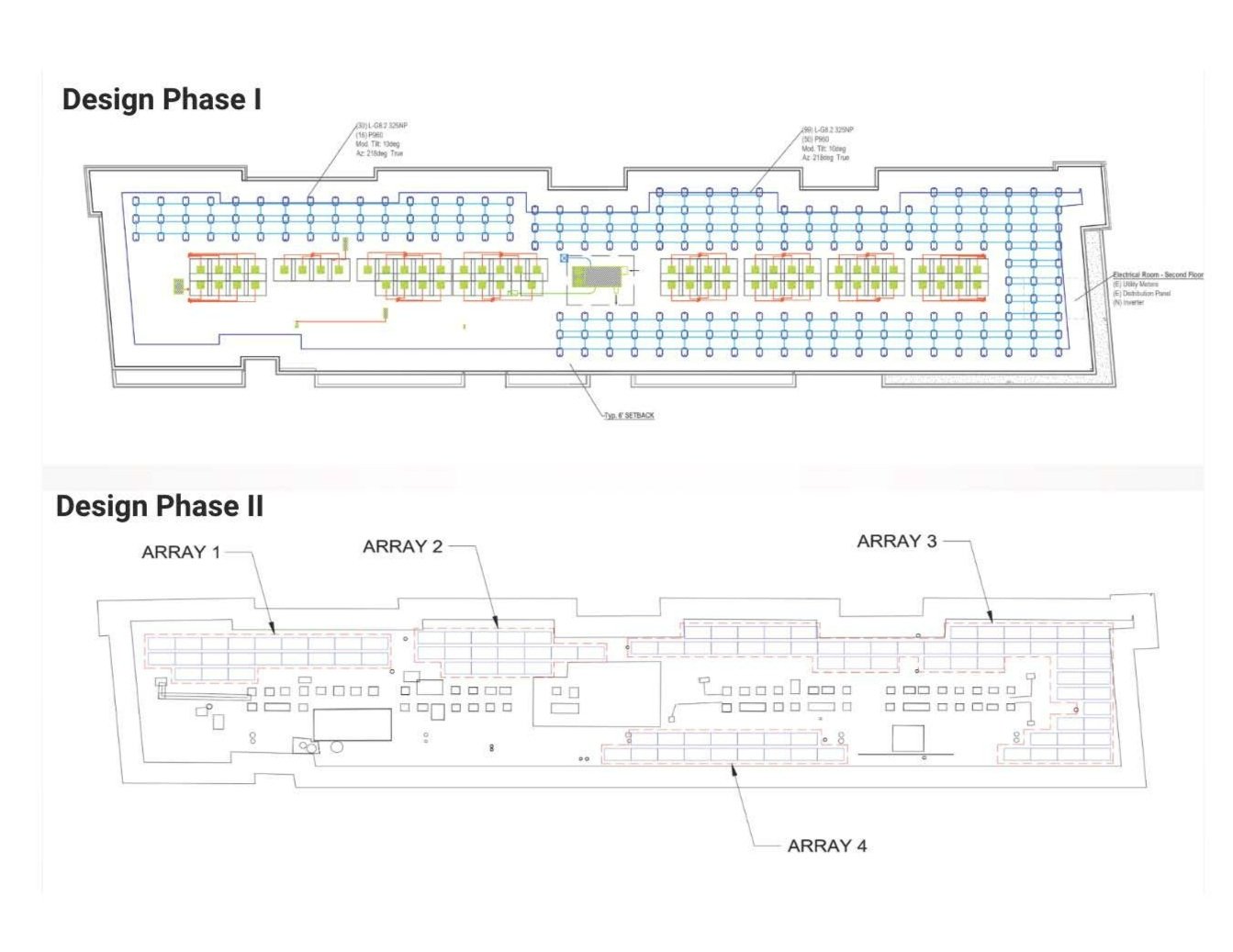

GETTING STARTED: DESIGN PHASES I & II

After a letter of intent has been signed and we receive 70%-100% complete construction drawings, Resonant will begin Design Phase I. Together we will review the construction drawings to identify the following items and recommend any necessary modifications to the construction drawing sets to incorporate solar design:

Structural:

Additional dead load bearing capacity of the roof in lbs/sqft (PSF). Note: for sloped roofs, we recommend min 5 PSF; for flat we recommend min 10 PSF

Electrical:

Behind the House Meter: The most common tie-in strategy for solar PV is to have a dedicated breaker (typically 150-200 amps for most multifamily projects) added to the house panel for us to back-feed. This is ideal based on the incentives in MA and also comes with the benefit of allowing us to complete our tie-in without shutting down power to the whole building for 8-12 hours.

Standalone Meter: it is possible to set up solar PV via a standalone meter and export the value of the electricity produced to other sites. This is much less common and requires robust advanced coordination to ensure the tie-in pathway is well planned for with the electrical engineer for the development.

Conduit:

Architects should include a 4” metal internal conduit from the roof to the electric room with as straight a shot as possible to be dedicated for solar PV as part of the GC scope.

Plumbing:

Vent Pipes - often can be moved. should be grouped in the middle of the flat roof or located as close as possible to the roof’s edge – or near other obstacles.

Roof Drains - generally can’t be relocated, but good to be mindful about placement to the extent possible as it will remove space where panels can be placed.

HVAC:

Equipment Placement: typically center spine of flat roofs and sited ground/attic for sloped roof sites. Most can’t be moved; however, choosing centralized VRF systems in lieu of single heat pumps for every unit can A) centralize load for solar to offset on the common meter and B) significantly reduce the amount of roof space needed for HVAC - leaving more space for solar.

Walkway Pads - typically can’t be moved, but are an obstacle for solar PV. Often not included in building drawings, so helpful to include if possible.

Gas Lines - can significantly disrupt solar and sometimes are not placed carefully. Be sure to highlight for the GC and subs to ensure no issues arise.

All other obstructions that would affect solar equipment placement

Roof Information:

Flat Roof Material Type: EPDM is the easiest to install solar on (can be procured in white if needed, though is most commonly black). White TPO is the most common material we’re seeing developers use due to its slightly lower cost, however, it can be challenging to install solar on this material due to the significant additional costs associated with waterproofing penetrations through the material compared to EPDM.

Sloped Roof Material Type: Asphalt is the most common material for sloped roofs.

Roof Material Manufacturer & Warranty: we need this information from the development team as soon as a vendor has been selected so we can proceed with the paperwork in advance of our installation to ensure that we preserve the roof warranty.

Additional Info: Roof slopes / tapered insulation depths are useful to know in determining the best racking type for the array. If not included in the designs, we will follow up. Greater slopes often mean that a fully ballasted racking design won’t work and we’ll have to have some penetrations.

Fall Protection:

Parapets & Rails: > 39” tall parapets and guardrails cover fall protection for ongoing solar maintenance needs; however, these are more expensive solutions and not frequently used, unless a parapet is required for other aspects of the building’s design.

Tiebacks: These are the most common type of fall protection used for solar and other fall protection needs due to their significantly lower cost. These should be placed either towards the center of the building or towards the outer edge (within 4’) to avoid impacting the space for solar PV. Note: you’ll always need one near the center of the roof where you enter so you can get to others on the roof safely.

Other:

Any other equipment that extends above the roof surface (e.g. antennas) or areas of the roof over which solar panels should not be installed (e.g. roof hatches) can pose a challenge as they are not always included in the full construction drawing set. In the past, we have seen this kind of equipment get installed without consulting solar and has resulted in losing modules.

Design Phase I

This first phase will yield a stamped preliminary electrical permit plan set which will allow us to apply for interconnection with the utility. After completing the Preliminary Solar Engineering Design, we will share the .dwg CAD files of the solar equipment placement. The solar equipment must be added to the architect’s building drawings so all parties are clear about where solar will be installed. Failure to capture all of these items in the initial design significantly increases the likelihood of future change orders and added costs.

Design Phase II

The second phase begins once the roof of the building has been completed and we can schedule a site visit with the solar installer. This site visit will identify what, if anything, has changed from our initial design plan to the as-built conditions and locations of roof obstructions. Based on past experience, changes from our preliminary plan set for interconnection and the final building design occur most commonly on flat roofs. New obstructions can often result in a solar design that is 5-10% smaller than earlier designs. Please see figure 1 for an example of changes made to a solar project due to new roof obstructions in the construction process. Reductions in system size beyond 5% will result in a change to the $/watt cost of the system (or, for systems financed through a no-cost Power Purchase Agreement (PPA), a change to the PPA year-one discount and/or PPA annual rate escalator).

With sloped roofs, final designs often closely match the preliminaries. To prevent reductions in array size, the Customer must hold their GCs accountable through planning and expectation setting to defend the roof space for solar and ensure the building is fully solar ready by the time we enter Design Phase II.

Figure 1. This is a photo of a new construction affordable housing solar project during Design Phase I and Design Phase II. As you can see, after the building was constructed and we performed a site visit, there were vent pipes placed in areas that conflicted with the solar array design from Design Phase I. This resulted in the loss of panels and a reduction in system size. Incorporating the solar design from Design Phase I into construction drawing sets is highly recommended to defend the roof space for solar and ensure all parties involved have the same design information.

SOLAR EQUIPMENT PLANNING/STAGING

While it is clear that building components and obstructions are an integral part of solar design planning, it is also important to plan accordingly for the solar equipment itself. Below is a list of equipment that will be added to the building as a result of installation:

Inverters: Can go on a roof penthouse (min 2.5’ off the ground), internally, or externally at ground level. Note: should be in a relatively shaded spot to avoid overheating and loss of productivity in the summer.

Conduit: If GC doesn’t have 4” metal conduit in their scope to get solar from the roof to the electric room, we will need to run an external conduit as part of our scope, which developers don’t typically like as much aesthetically. Note: if the electric room is not adjacent to the exterior of the building, the GC also needs to install 2x 2.5” metal conduits to allow us to get from the electric room to the exterior to locate a required disconnect switch for first responders.

SMART Meter and Disconnect Interior Placement: If the building has an underground service drop and the meter bank is interior, the utility will typically require “meter grouping” with the SMART meter inside and two disconnects (one outside and one inside)

SMART Meter and Disconnect Exterior Placement: If the building has an overhead drop and external meters, then the disconnect and SMART meter must be outside, near the meter bank (typically outside the electric room)

ROOF READINESS: STRUCTURAL PLANNING AND RACKING SOLUTIONS